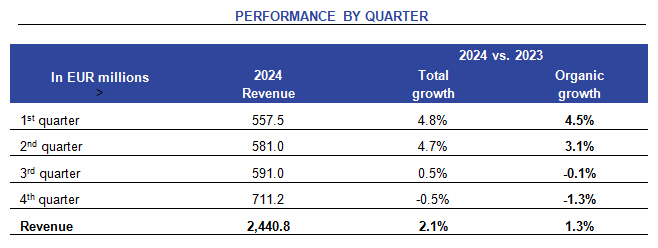

Ipsos has announced 2024 revenue up 2.1% (1.3% in organic terms) to EUR 2,440.8m. Good growth in Latin America, the Middle East and most of Europe was offset by a 'weaker-than-expected' performance in the US, plus a business slowdown in the UK, France and some Asian countries. Adjusted net profit of EUR 250.2m was up 6.9% year-on-year, with operating margin rising to 13.1%. Fourth quarter results appeared more disappointing, with revenue dropping 1.3% (organic basis) vs the same quarter a year earlier - but this reflects very strong Q4 2023 growth (8.8%).

Adjusted net profit of EUR 250.2m was up 6.9% year-on-year, with operating margin rising to 13.1%. Fourth quarter results appeared more disappointing, with revenue dropping 1.3% (organic basis) vs the same quarter a year earlier - but this reflects very strong Q4 2023 growth (8.8%).

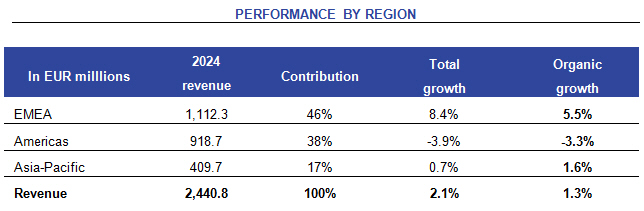

In EMEA, Ipsos' largest region with 46% of total revenue, organic growth of 5.5% was driven by strong results in Germany, Italy, Belgium and the Netherlands, and in the Middle East. A slowdown in France was driven by 'a climate of uncertainty since the summer', with government and private sector spending hit.

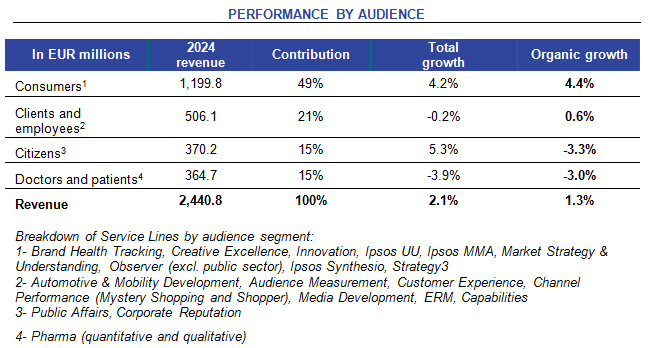

In the Americas, the Public Affairs and Healthcare businesses have been the hardest hit, while Ipsos' consumer analysis service lines are said to be performing well. Outside the United States, the Group's Americas organic growth was 4.5%.

In the Asia-Pacific region, business in China was stable despite the lack of 'a tangible economic recovery', but growth elsewhere was impacted by a slowdown of activity in India in the second half, following record growth in 2023 (c.20%).

Service lines dedicated to citizens, doctors and patients are in decline in the US for 'a combination of unfavourable factors', but elsewhere fared reasonably well, rising more than 3%. In the US, pharma industry restructuring and political uncertainty were among the factors contributing to declining sales.

Consumer insights work drove the company's overall positive result, with organic growth of more than 4% in 2024, helped by the group's DIY platform Ipsos.Digital, whose revenues rose 30%. Ipsos says its 'new services' - which include platforms, ESG offerings, advisory, science and data - now account for just over 22% of Group revenue, with organic growth of 10% over the year.

The group, which is almost debt-free, now holds an Investment Grade rating from Moody's and Fitch and has successfully refinanced its bond debt, giving it a strong financial base from which to pursue its objectives, including acquisitions - today it announced the buying of Brazilian polling firm Ipec. A gradual improvement in business growth is expected in 2025.

Global CEO Ben Page comments: 'Despite slowing growth, the improvement in gross margin and careful cost management enabled us to deliver a good level of profitability. Ipsos' financial health is also reflected in strong cash generation, virtually debt-free status and Investment Grade ratings by Moody's and Fitch. Our recent acquisitions have cemented our leadership in Public Affairs and Data Analytics. Finally, we will continue to invest in our panels, platforms and Generative AI to deliver even faster cutting-edge insights to our clients'.

Home page: www.ipsos.com .

All articles 2006-23 written and edited by Mel Crowther and/or Nick Thomas, 2024- by Nick Thomas, unless otherwise stated.

Register (free) for Daily Research News

REGISTER FOR NEWS EMAILS

To receive (free) news headlines by email, please register online